32+ mortgage interest deduction cap

Web But under the new rules while youll still have to pay the 24000 in state and local taxes you wont be able to deduct your entire payment amount. Lock Your Rate Today.

Mortgage Interest Deduction A Guide Rocket Mortgage

This cap on mortgage.

. You would only be. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. We dont make judgments or prescribe specific policies.

Web March 4 2022 439 pm ET. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Mortgage interest deduction limit on a refinance mortgage I received a notification that this was fixed with todays update 21121 but it is still not calculating.

Households claiming the home mortgage interest deduction declined. Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Homeowners who bought houses before.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Lets say you paid 10000 in mortgage interest and are.

Web Under current law individuals who itemize can deduct interest paid on their mortgage up to 750000 in principal from their taxable income. Web The mortgage interest deduction got a new limit One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage. For taxpayers who use.

Ad 10 Best Home Loan Lenders Compared Reviewed. Comparisons Trusted by 55000000. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Consider that the standard deduction for 2019 is 12200 for single filers and 24400 for those who are married and file jointly. Web If youve closed on a mortgage on or after Jan. Web Depending on how big your mortgage is you may encounter a cap on the interest you can deduct.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. If your mortgage was in place on December 14 2017 you can. That means your combined deductible.

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. See what makes us different.

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Capping Mortgage Interest Deduction To 500 000 What Does It Mean Jvm Lending

Mortgage Interest Deduction Limit And Income Phaseout

The Home Mortgage Interest Deduction Lendingtree

Bonus Depreciation Definition Examples Characteristics

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction What You Need To Know Mortgage Professional

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

The Modified Home Mortgage Interest Deduction

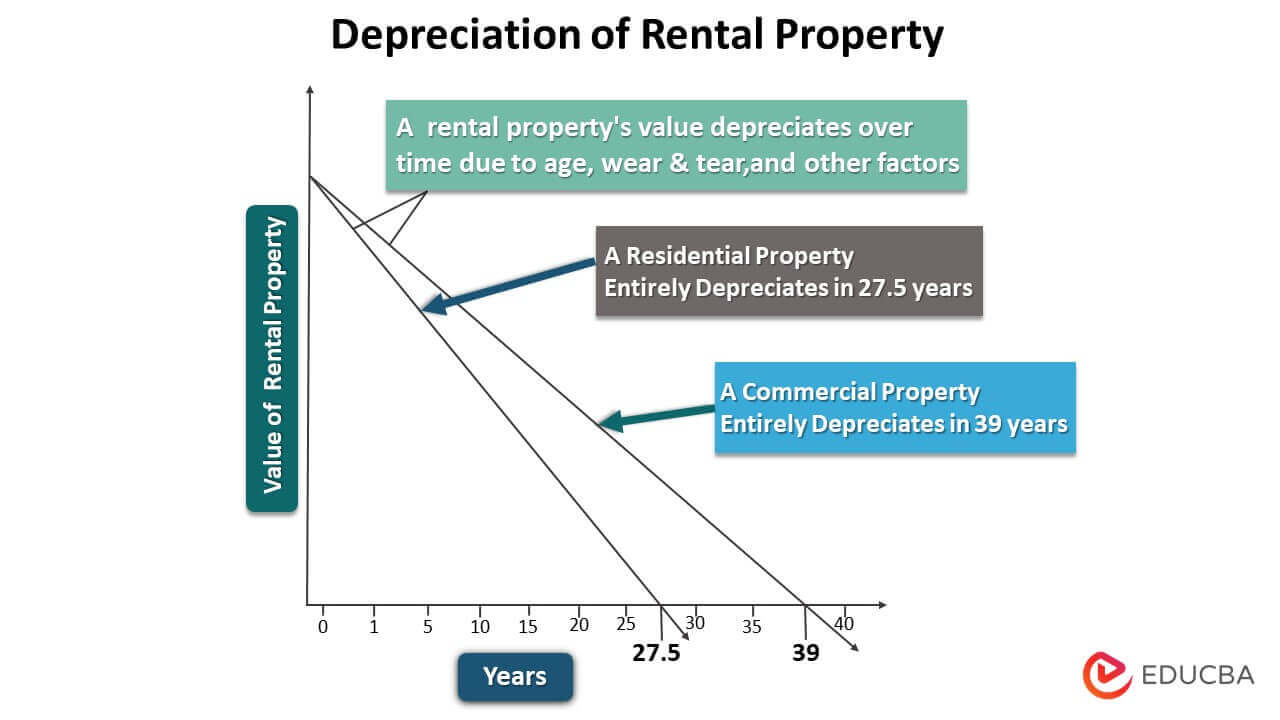

Depreciation For Rental Property How Does It Work Eligibility Examples

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Race And Housing Series Mortgage Interest Deduction

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-1311546186-bcbce3839b544ec1b3115552c20b8b52.jpg)

Home Equity Loans And The Cap On Home Loan Tax Deductions

Sec Filing Nkarta Inc

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves